2019 Real Estate Forecast

Read our report that recaps 2018 market activity and highlights the trends that will shape data center real estate in 2019.

Download the 2019 Report (PDF) »

Overview of Issues Impacting Data Centers During 2018

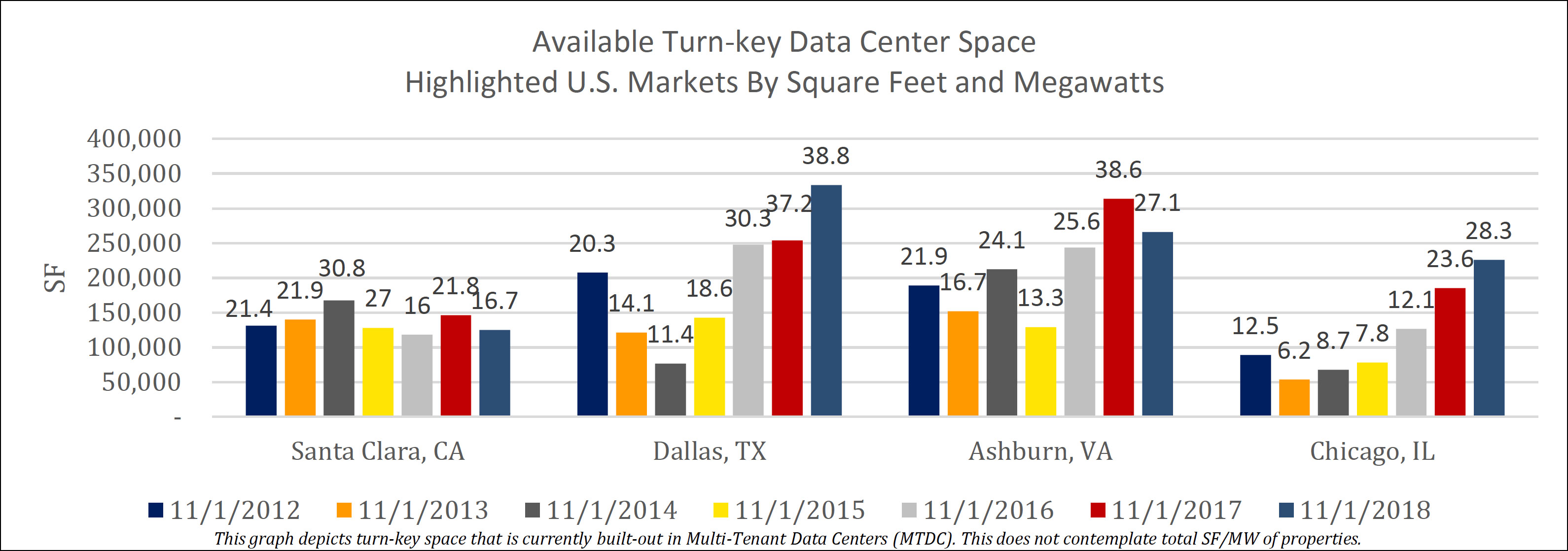

- Multi-Tenant Data Center (MTDC) leasing more than doubled in 2018 compared to 2017.

- Leasing activity in Northern Virginia (NOVA) for data centers was more than two and a half times all other markets combined in 2018.

- Overall rental rates have decreased as a result of new operators and investors and hyperscale users demanding volume pricing.

- These massive cloud users once again dominated leasing activity in 2018.

- Overall volume and value of investment activity were down from 2017, but several highly anticipated strategic transactions will set the course for a couple of larger operators.

- Given the proliferation of new capital and an increase in stabilized assets, developers will use joint ventures to fund their expansions.

- Significant increase in land acquisition to bank for future development dominated by NOVA.

- Land sales are nearing $2.0 million an acre in Ashburn, and as such, Prince William County and Fauquier County have seen an uptick in land sales topping off at $425,000 and $250,000, respectively.

- Large enterprises sold data center properties as sale-leasebacks or vacant assets.

- Cap rate compression led to additional sales on recently traded long-term stabilized assets.

- The roll out of turnkey leases in 2008-2009, coupled with a proliferation of shorter-term leases signed in 2013-2014 has led to significant increase in leases expiring in 2019 and 2020.

- Dallas leased over 40 MW of space mostly through expansions.

- Chicago leased more than 20 MW of space in 2018, mostly to smaller tenants.

- New speculative space in Santa Clara met with strong leasing activity, particularly by Chinese technology companies.

- Leasing activity in Atlanta has been limited, and developers have been slow to build despite numerous new projects announced in 2017.

- Tenants expanding and new large campus developments contributed to robust leasing in Salt Lake City and Phoenix in 2018.

- Leasing activity in Quebec was dominated by cryptocurrency and Amazon leased 6 MW at two locations.

- DLR had some recent success with U.S. cloud operators in Toronto.

- Acceleration of blockchain throughout the U.S. and Canada in 2018 met with pushback on utility pricing.

- Significant challenges have emerged thus far for landlords and tenants reaching terms for blockchain.

- New projects by operators expected in several markets during 2019 will face challenges related to timing due to supply chain constraints.

- A significant uptick in construction costs are expected as a result of a decrease in the supply chain brought on by hyperscale data center users.

- Costs will be exacerbated by steel and aluminum tariffs and electronic components from China.

- Shortages of labor in NOVA, the Bay Area, and Washington will delay the delivery of some data center operator projects.

Investment Activity 2018

| Buyer | Seller | Size SF | Market | Sales Price | Comments |

| INAP | Singlehop | Chicago, IL | $132 MM | 7x EBITDA | |

| Landmark Infrastructure | Lexington Realty Trust | 84,000 | Omaha, NE | $16.4 MM | Wipro – 7.1% cap rate |

| GI Partners | RXR Realty | 130,009 | Nutley, NJ | $42.9 MM | BT Americas |

| Iron Mountain | IO Data Centers, LLC | 530,856 | Phoenix, AZ | $106.875 MM | 9 acres & 60 MW Adj |

| Iron Mountain | IO Data Centers, LLC | 125,000 | Scottsdale, AZ | $35.625 MM | |

| Carter Validus | Digital Realty | 69,048 | Rancho Cordova, CA | $36.8 MM | SunGard – 8.97% cap |

| Carter Validus | Digital Realty | 63,791 | Rancho Cordova, CA | $14.2 MM | Windstream – 8.45% cap |

| Carter Validus | 62,002 | McLean, VA | |||

| CIM Group LP / 1547 | Green House Data | 42,000 | Cheyenne, WY | ||

| eStruxture | Duke Realty | 446,811 | Sterling, VA | $109.9 MM | United – 5.25% cap rate |

| Equinix | ASB / DCI | 1.6 MM | Dallas, TX | $800 MM | 33-35x EBITDA |

| IPI Partners | T5 Data Centers | Kings Mountain, NC | Boeing | ||

| Landmark Infrastructure | Carter Validus | 59,516 | Hartland, WI | $21 MM | 8.4 % cap rate |

| Alpharetta DC, LLC | Carter Validus | 165,000 | Alpharetta, GA | $62.2 MM | E-trade – 6.79% cap rate |

| Carter Validus | KSB Real Estate Trust | 76,410 | San Jose, CA | $49.15 MM | AT&T 7yr lease |

| Brookfield Infrastructure | AT&T | Portfolio | Various | $1.1 BN | 9-10x EBITDA |

| Landmark Infrastructure | Cyxtera | 57,000 | Lewis Center, OH | $5.71 MM | Cyxtera – 6.74% cap rate |

| Research Way Investments | Bluegrass Partners Bank | 376,000 | Lexington, KY | $15.9 MM | Valvoline – court sale |

| Lincoln Rackhouse/Principal | Bank of America | 259,111 | Kansas City, MO | $26 MM | Vacant |

| Lincoln Rackhouse/Principal | Bank of America | 191,061 | Chandler, AZ | $39.7 MM | INAP – 4.5% cap rate |

| Lincoln Rackhouse Principal | Bank of America | 454,421 | Plano, TX | $81.35 MM | Partial sale/leaseback |

| DI Assetco LLC (Landmark) | RS, Almeda, LLC | 27,000 | Santa Clara, CA | $37 MM | |

| Ensono | Wipro | Portfolio | Various | $405 MM | |

| H5 Data Centers | Intuit, Inc. | 240,000 | Quincy, WA | $41 MM | Partial sale/leaseback |

| Landmark Infrastructure | 75,119 | Richardson, TX | $36.6 MM | SunGard – 7.8% cap rate | |

| Pinchal | Skybox | 150,000 | Plano, TX | $48 MM | Blockchain |

| Menlo Equities | Carter Validus | 92,700 | Andover, MA | $15 MM | Windstream – 6.64% cap |

| Landmark Infrastructure | Louis J. Eyde Family | 132,456 | Hazelwood, MO | $50 MM | Reuters – 6.6% cap rate |

| EdgeConnex | Merit Partners, Inc. | 79,183 | Tempe, AZ | $15.63 MM | 6.5% cap rate |

| IPI Partners | T5 Data Centers | 221,336 | Elk Grove Village, IL | $118.9 MM | |

| IPI Data Centers | ASB Real Estate | Portfolio | Various | TBD | |

| Carter Validus | Douglas Draper, TTEE | 25,321 | St. Louis, MO | $3.2 MM | Verizon – 7.79% cap rate |

| Affiliate of Next Tier HD | Stream Data Centers | 75,676 | Chaska, MN | $77.5 MM | US Bank – 6.8% cap rate |

| IPI Data Centers | ASB Real Estate | Portfolio | Various | TBD | |

| Raymar Land | State Automobile Mutual | 25,589 | Columbus, OH | $4.45 MM | Vacant |

| Rock Creek | DC II 4726 | 29,960 | Canton, OH | $9.4 MM | 100% – 8.2% cap rate |

| IPI Partners | Clarion Partners | 88,470 | Tukwila, WA | $53.5 MM | Century Link |

| Carter Validus | 21,800 | Hartford, CT | $5.2 MM | Verizon | |

| CIM Group LP / 1547 | Digital Capital | 66,000 | Chicago, IL | $27 MM | |

| Vantage | 4 Degrees | Portfolio | Various | $200 MM |

Big Red Wines We Really Enjoyed During 2018

- Amici To Kalon Cabernet Sauvignon 2015 (2N)

- Behrens Clearing the Way 2013 (N+1)

- Chateau Smith Cabernet Sauvignon 2015 (N)

- Revana Cabernet Sauvignon 2014 (N+1)

- Orin Swift 8 Years in the Desert Red Wine 2016 (N+1)

- Melanson Matthew’s Block Cabernet Sauvignon 2012 (N+1)

- Clif Family Cold Springs Cabernet Sauvignon 2015 (N+1)

- Fantesca All Great Things Red Wine 2015 (2N)

Largest Wholesale Turn-Key Leases During 2018

| Tenant | Market | Provider | (MW) |

| Manassas, VA | Cloud HQ | 72 MW | |

| Salesforce | Manassas, VA | QTS | 26 MW |

| Microsoft | Manassas, VA | Cloud HQ | 25 MW |

| Ashburn, VA | DLR | 25 MW | |

| Microsoft | Ashburn, VA | CONE | 20 MW |

| TBD | Ashburn, VA | DLR | 20 MW |

| Streamcast | Las Vegas, NV | Switch | 15 MW |

| HUG (PBB) | Houston, TX | Skybox | 15 MW |

| Microsoft | Ashburn, VA | RagingWire | 14 MW |

| INAP (BoA) | Chandler, AZ | Lincoln | 10 MW |

| Microsoft | Toronto, CA | DLR | 10 MW |

| Microsoft | Ashburn, VA | CONE | 10 MW |

| Salesforce | Ashburn, VA | CONE | 6 MW |

| Salesforce | Ashburn, VA | DLR | 6 MW |

| China Telecom | Santa Clara, CA | DLR | 6 MW |

| Microsoft | San Antonio, TX | CONE | 6 MW |

| Alibaba | Ashburn, VA | CONE | 5 MW |

| Microsoft | Ashburn, VA | DLR | 5 MW |

| Tenant | Market | Provider | (MW) |

| SAP | Ashburn, VA | DLR | 5 MW |

| Microsoft | Phoenix, AZ | CONE | 5 MW |

| Salt Lake City, UT | Aligned | 5 MW | |

| Nokia | Suburban Chicago, IL | DLR | 3.3 MW |

| Alibaba | Ashburn, VA | CONE | 3 MW |

| Oracle | Toronto, CA | DLR | 3 MW |

| TBD | Denver, CO | Flexential | 2.5 MW |

| Chicago, IL | EQIX | 2.4 MW | |

| Chicago, IL | QTS | 2 MW | |

| Oracle | Dallas, TX | QTS | 2 MW |

| TBD | Hillsboro, OR | Infomart | 2 MW |

| Blockchain | Montreal, CA | Estruxture | 2 MW |

| PayPal | Salt Lake City, UT | Aligned | 2 MW |

| Criteo | Dallas, TX | Aligned | 2 MW |

| Nutanix | Phoenix, AZ | Aligned | 2 MW |

| Jack Henry | Allen, TX | Compass | 2 MW |

| PayPal | Phoenix, AZ | Aligned | 2 MW |

| Salesforce | Phoenix, AZ | CONE | 2 MW |

| Workday | Portland, OR | Flexential | 2 MW |

| Delta | Atlanta, GA | T5 | 2 MW |

For the largest wholesale transactions, the numbers set forth represent what is believed to be the total commitment of the lease agreement. Under construction refers to white space being built. These numbers do not contemplate expansions. Information is from sources deemed reliable.

Learn more about North American Data Centers »