2020 Real Estate Forecast

Read our report that recaps 2019 market activity and highlights the trends that will shape data center real estate in 2020.

Download the 2020 Report (PDF) »

Overview of Issues Impacting Data Centers During 2019

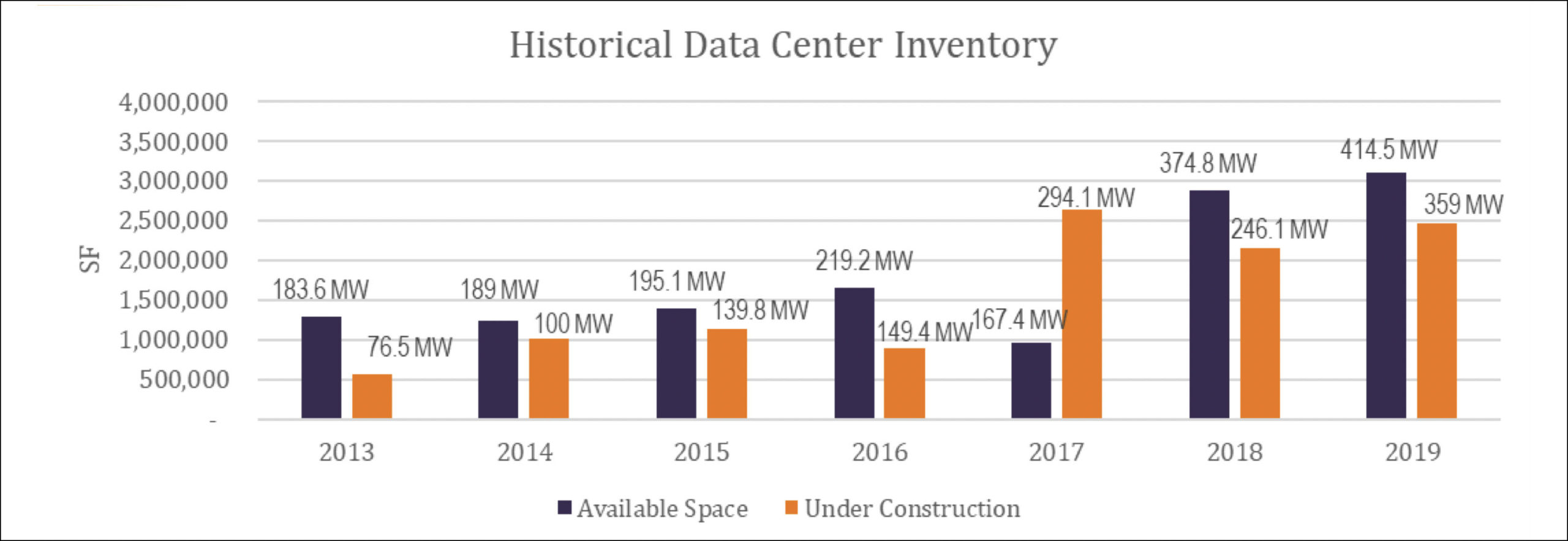

- Overall leasing activity, although significantly lower than in 2018, was consistent with 2017.

- The slowdown in leasing can be directly attributed to the hyperscale tenants that Microsoft leads.

- Northern Virginia felt the strongest impact given the huge increase in the year-over-year speculative inventory.

- Renewals increased massively in 2019. Digital Realty(DLR) reported 1.7 mm square feet of renewals for the first nine months of 2019, which was 10% higher than in 2017 and 2018 combined. The acquisition of DuPont Fabros in 2017 accentuated the combined companies’ lease expirations.

- Renewals will continue during 2020, especially in Q1.

- Publicly traded companies reported that, on average, retention rates exceeded 81%.

- The overall slowdown in hyperscale leasing activity was partially offset by a rebound in enterprise activity.

- Publicly traded companies reported an overall drop in rental rates for multi-tenant data centers (MTDCs) in 2019 through the third quarter.

- Digital lead strong leasing activity in the Northwest.

- Smaller colocation customers are paying significantly higher rental rates, particularly for renewals.

- New Jersey achieved a large increase of more than 10 MW in leasing by financial firms.

- Ridesharing companies and others created shadow inventory, particularly in the Bay Area.

- More companies were looking at risk diversification by leasing outside of Northern Virginia. Is Atlanta the beneficiary?

- Activity in Chicago has been focused on smaller enterprise users and renewals. Microsoft purchased 42 acres in January 2020 and Cyxtera master leased 130,000 square feet of property that Stack owns.

- An uptick in leasing in Toronto and Montreal by US hyperscales has decreased the supply of MTDCs in Canada.

- Several hyperscale companies acquired large parcels of land in the US to develop data centers.

- The repatriation of on-premise data centers by companies leaving the cloud; myth or reality?

- A slowdown occurred overall in investment sales activities in 2019 despite an uptick in buyers.

- Investment activity increased in secondary markets.

- The sale/leaseback of corporate data centers will increase in 2020 as several portfolios were taken off the table in 2019.

- In addition to smaller edge data centers, a surge in regional data centers driven by companies seeking stronger links to their customers is necessary.

- The retiring IT workforce will be replaced with younger decision makers who will spur changes that differ from those at traditional enterprise data centers.

North American Data Centers completed more than 2 MM square feet of data center sales during 2019.

2019 Highlighted Land Sales

| Buyer | Location | $/Acre | Total Acres |

| Microsoft | Elk Grove Village, IL | $1.45 MM | 36 * |

| Switch | Las Vegas, NV | $777,000 | 36 |

| Microsoft | Goodyear, AZ | $250,000 | 36 |

| Digital Realty | Ashburn, VA | $2.14 MM | 13 |

| Coresite | Santa Clara, CA | $6.9 MM | 3.8 |

| Lightstone | Santa Clara, CA | $5.89 MM | 1.8 |

* January 2020

Investment Activity 2019

| Buyer | Seller | Size SF | Market | Sales Price | Comments | |

| Landmark Infrastructure | Element Critical | 1/19 | 150,480 | Wood Dale, IL (Chicago) | $13.5 MM | Sungard |

| GI Partners | NTT Data | 1/19 | 180,000 | Quincy, WA | $50 MM | NNN / Sale Leaseback |

| GI Partners | NTT Data | 1/19 | 1,082,673 | Plano, TX | $60 MM | NNN / Sale Leaseback 70% Office |

| Databank (Legacy) | PNC Bank | 1/19 | 115,000 | North Lafayette Twsp., PA | $26.4 MM | PNC 6.5% cap rate |

| CIM | 1547 | 1/19 | 232,000 | Orangeburg, NY | $86.6 MM | Partially occupied MTDC |

| Northington Huntington Beach Investors, LLC |

FLP Huntington Beach, LLC |

1/19 | 114,000 | Various | $82.975 MM | 3 NNN Frontier Communications |

| Silver Peak & Legacy | PNC Bank | 2/19 | 387,000 | Cleveland, OH | $51.7 MM | PNC leaseback |

| Landmark Dividend | Goldcoast Data | 2/19 | 62,966 | Fort Lauderdale, FL | $25.45 MM | Flexential |

| Alinda Capital | QTS | 2/19 | 118,000 | Ashburn/Manassas, VA | $240 MM | JV 6.75% Cap Rate |

| 35711 Properties I, LLC | DXC Technology | 3/19 | 75,233 | Rancho Cordova, CA | $7.12 MM | |

| AGC Equity | Ensono, Inc. | 3/19 | 215,000 | Kings Mountain, NC | $70 MM | |

| T5 Charlotte, LLC | T5 / Iron Point | 4/19 | 146,000 | Kings Mountain, NC | $86 MM | Recapitalization |

| Lincoln Rackhouse | ByteGrid | 5/19 | 73,297 | Aurora, IL | $20.5 MM | Former CNA Insurance |

| Lincoln Rackhouse | ByteGrid | 5/19 | 214,006 | Silver Spring, MD | $34 MM | Former Citi data center |

| Lincoln Rackhouse | ByteGrid | 5/19 | 50,000 | Lynnwood, WA (Seattle) | $5.5 MM | |

| Woodbery Group | JM Family | 5/19 | 87,972 | Alpharetta, GA | $10.75 MM | Datascan 3 Yr. Leaseback |

| Blackstone | COPT | 6/19 | 1,200,000 | Manassas, VA | $265 MM | (7) NNN Powered Base Shells |

| Landmark Infrastructure | 6/19 | 66,666 | Charlotte, NC | $18.4 MM | 100% leased to Flexential through 05/24 | |

| Menlo Equities | Lincoln Rackhouse | 7/19 | 208,340 | Marlborough, MA | $33.3 MM | Tierpoint/Lightower |

| CBRE Global Investors | Lincoln Rackhouse | 8/19 | 191,000 | Chandler, AZ | $72.75 MM | INAP 100% NNN Sold in June 2018 for $39.7 MM |

| Macquarie | Netrality | 9/19 | 3,107,360 | Various | 6 Carrier Hotels | |

| Mapletree Investments | Digital Realty | 9/19 | 1,376,000 | Various | $557 MM | JV 10 PBB 6.6% Cap Rate |

| Mapletree Investments | Digital Realty | 9/19 | 703,847 | Ashburn, VA | $1.013 MM | JV 3 Virginia MTDC 6% Cap Rate |

| Digital Realty | Interxion | 10/19 | Company | Various | $8.5 BN | 21-21.5 X EBITDA |

| SBA Communications | New Continuum | 10/19 | 80,000 | West Chicago, IL | $13.8 MM | Colocation Facility |

| Stack Infrastructure | Nationwide Insurance | 10/19 | 120,000 | New Albany, OH | $9.7 MM | Tier III – Nationwide Leaseback |

| Blackstone | Clarion Partners | 10/19 | 228,110 | Emeryville, CA | $126 MM | Multi-tenant DC, Telco and Office |

| Blackstone | COPT | 12/19 | 297,160 | Ashburn/Manassas, VA | $80 MM | (2) NNN Powered Base Shells |

Capitalization rates and EBITDA multiples are provided from sources deemed reliable.

Big Red Wines We Really Enjoyed During 2019

- Terra Valentine Spring Mountain Cabernet Sauvignon 2014(N+1)

- Celani Ardore Coombsville Napa Cabernet Sauvignon 2016(2N)

- Leviathan California Red Wine 2016(N)

- J. Lohr Pure Paso Cabernet Sauvignon Blend 2017(N)

- Bella Union Napa Valley Cabernet Sauvignon 2016(2N)

- Grand Napa Vineyards Rutherford Cabernet Sauvignon 2014(N)

- Stewart Cellars, Slingshot, Cabernet Sauvignon 2016(N)

- Au Sommet Atlas Peak Cabernet Sauvignon 2015(2N+1)

Largest Wholesale Turn-Key Leases During 2019

| Tenant | Market | Provider | (MW) |

| Cyxtera (Renewal) | Multiple Markets | DLR | 300,000 SF |

| FaceBook (Renewal) | Multiple Markets | DLR | 80 MW |

| Twitter (Renewal) | Sacramento, CA | NTT | 27 MW |

| Hillsboro, OR | DLR | 12 MW | |

| Atlanta, GA | QTS | 12 MW | |

| Microsoft | Santa Clara, CA | COR | 10 MW |

| Microsoft | Toronto, Canada | Urbacon | 10 MW |

| Cyxtera | Elk Grove Village, IL | Stack | 130,000 SF |

| Bloomberg | Piscataway, NJ | DLR | 90,000 SF |

| Dropbox | Portland, OR | Flexential | 9 MW |

| ByteDance | Ashburn, VA | DLR | 9 MW |

| Alibaba | Northern VA | DLR | 7.5 MW |

| Dallas, TX | DLR | 6 MW | |

| AWS | Northern VA | IRM | 6 MW |

| Nvidia | Santa Clara, CA | Vantage | 6 MW |

| Box | Las Vegas, NV | Switch | 6 MW |

| FedEx | Las Vegas, NV | Switch | 5 MW |

| Cloud Provider | Las Vegas, NV | Switch | 5 MW |

| Tenant | Market | Provider | (MW) |

| Alibaba | Northern VA | CONE | 4.5 MW |

| USAA | San Antonio, TX | CONE | 4.5 MW |

| Microsoft | Santa Clara, CA | Stack | 4.2 MW |

| Government Contractor | Fort Worth, TX | QTS | 4.1 MW |

| Northern VA | Stack | 4 MW | |

| Dallas, TX | QTS | 4 MW | |

| Uber | Phoenix, AZ | Aligned | 4 MW |

| Dropbox | Northern VA | Vantage | 3 MW |

| T-Mobile | Plano, TX | Stack | 3 MW |

| Box | Reno, NV | Switch | 3 MW |

| Bloomberg | Piscataway, NJ | DLR | 2 MW |

| Northern VA | Vantage | 2 MW | |

| Express Scripts | New Jersey | DLR | 2 MW |

| Toyota | Dallas, TX | CONE | 2 MW |

| Workday | Hillsboro, OR | QTS | 2 MW |

| World Bank | Ashburn, VA | QTS | 2 MW |

| Uber | Ashburn, VA | QTS | 2 MW |

| Oracle | Toronto, Canada | DLR | 2 MW |

For the largest wholesale transactions, the numbers set forth represent what is believed to be the total commitment of the lease agreement. Under construction refers to white space being built. These numbers do not contemplate expansions. Information is from sources deemed reliable.

Learn more about North American Data Centers »