2021 Real Estate Forecast

Read our report that recaps 2020 market activity and highlights the trends that will shape data center real estate in 2021.

Download the 2021 Report (PDF) »

Overview of Issues Impacting Data Centers During 2020

- Overall, Multi-Tenant Data Center (MTDC) leasing activity in the US in 2020 was just under 700 MW was more than three times greater than that in 2019 and twice that of 2018, which means it was the best all-time year for MTDC leasing.

- Several of these transactions involved the expansions of hyperscale tenants in the same location.

- Northern Virginia (NOVA) led the charge, leasing more than 500 MW which doubled 2018 and was 80% of the total for US & Canada.

- The low rental rates resulting from the significant inventory at the beginning of the year in NOVA increased (for the smaller tenants) during the third and fourth quarters.

- Microsoft dominated the leasing on a national basis, supplemented by Bytedance (Tik Tok) and Facebook in Northern Virginia, and Cloud HQ, Aligned, and Digital Realty Trust were the beneficiaries of this leasing

- The strong leasing activity during the second quarter stemmed from hyperscale companies, as many of these tenants pulled forward their requirements as a result of the distributed work-force and the work-from-home lifestyle.

- In addition to remote work, online gaming, social media, video streaming, and ecommerce all drove leasing activity during the pandemic.

- An uptick occurred in enterprise, and hyperscale users focused on their carbon footprints. Data center operators matched this by increasing their use of renewable energy.

- Tenants increasingly are finding landlords more receptive to porting some of their load once again giving operators with multiple footprints advantage to the one offs.

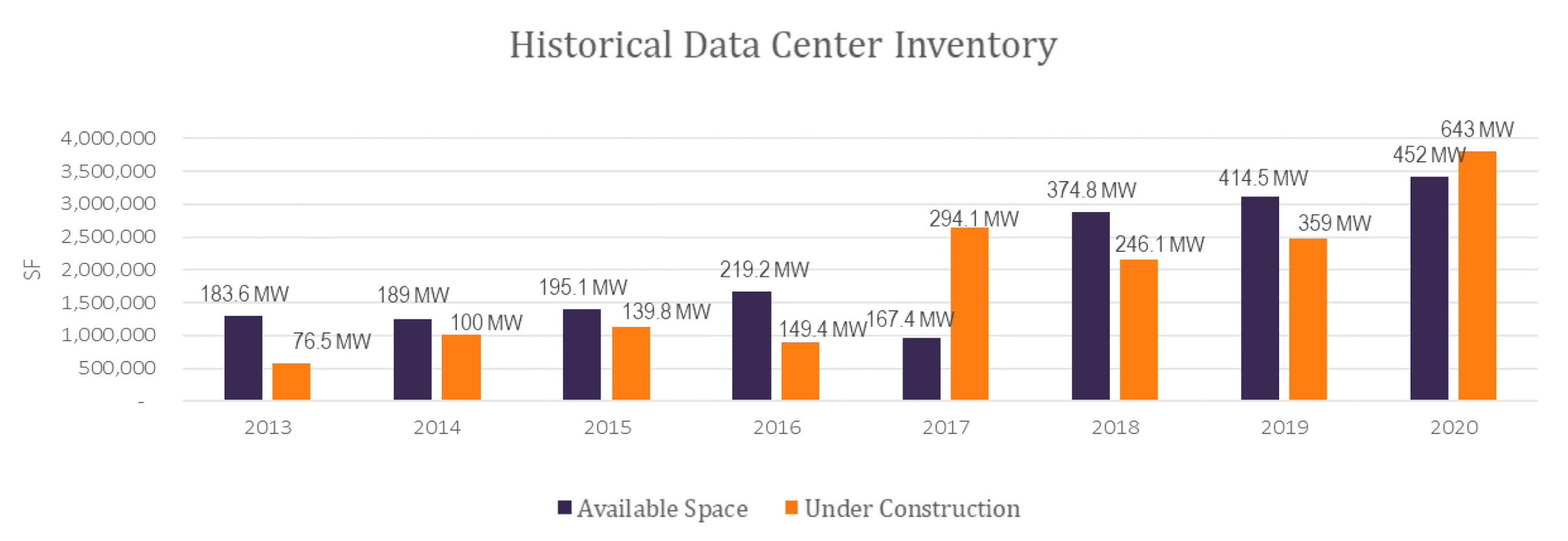

- Under construction numbers for the first time surpass space available as noted in graph, mostly driven by Northern Virginia as NOVA supply was significantly higher last year.

- Several of the third-party data center operators reported the repatriation of enterprise users from the cloud.

- Much of the enterprise’s leasing took place in the first quarter, before the pandemic slowed down its leasing. Expect the leasing activity for those users to pick up during 2021, after we overcome the logistics of acquiring new sites.

- Chicago had its strongest year during the past three years with more than 45 MWs leased by Microsoft and in 2021 they will have more than 400,000 square feet under construction in the suburbs. Downtown also had strong leasing, led by QTS. Furthermore, Skybox and Stream have acquired properties to expand.

- Other notable markets in 2020 was the Bay Area led by Microsoft and Atlanta had success that benefitted primarily QTS. Activity in Phoenix was driven by Oracle and Microsoft.

- Dallas continues to struggle landing hyperscale coupled in 2020 with lack of enterprise leasing.

- Overall one-off investment activity slowed down due to the pandemic. However, a significant increase in volume occurred.

- During 2020, several mergers with fiber and data centers as well as acquisitions with low cap. rates have once again reemphasized the importance of connectivity.

- A significant increase in capital from insurance companies, pension funds, sovereign funds, and traditional real estate investors, coupled with the reallocation of capital from other real sectors, will lead to a dramatic decrease in the cap. rates in 2021. The strategies are as diverse as the investors them-selves, and, in general, they have not created a surplus.

- 14 data center properties have been traded twice during the past 4 years. The average hold time was 2.7 years, and the average nominal return was 89%.

- There has been an increase in investors becoming comfortable with shorter-term leases; most of the publicly traded companies report a 7.25-year average term length.

- Merger and acquisition activity should remain strong in 2021 due to the aforementioned, as well as private equity firms exiting their mature investments.

Investment Activity 2020

| Buyer | Seller | Date | Size SF | Market | Sales Price | Comments |

| Colony Capital | Databank | 1/20 | various | $185 MM | 17.5 X EBITDA | |

| MapleTree | Digital Realty | 1/20 | 381,387 | Aurora, CO | $97.42 MM | Flexential leases 171,289 sf 6.63% Cap. Rate |

| Landmark Dividend | Paypal | 2/20 | 134,856 | Phoenix, AZ | $122 MM | Partial Sale/Leaseback – 7% Cap. rate |

| Digital Realty | Clise Properties | 2/20 | 400,000 | Seattle, WA | $305 MM | 5.7 % Cap. Rate, Exp. Ownership from 49% |

| Landmark Dividend | Individual | 4/20 | 61,080 | Louisville, KY | $7.35MM | Flexential leased |

| Harvest Properties | CIM Group | 4/20 | 105,800 | San Francisco, CA | $99MM | Carrier Hotel SOMA(95% leased) |

| Alliance Consolidated | MVTC, LLC | 6/20 | 35,908 | Marietta, GA | $5.95 MM | Sagenet 100% -15yr. 7.5% cap. rate |

| Liberty Mutual | Microsoft | 6/20 | 72,593 | Redmond, WA | $15.3 MM | Partial short term sale/leaseback |

| Equinix | Bell Canada | 6/20 | 1,600,000 | Various | $780 MM | 25 properties – 15X EBITDA |

| Landmark Dividend | C.H. Robinson | 7/20 | 32,000 | Oronoco, MN | $5.5 MN | CH Robinson sale/leaseback – 5yr |

| Colony Capital | Vantage | 7/20 | 1,400,000 | Various | $3.5 BN | Recapitalization @ 20 x EBITDA |

| SBA- Edge | MetroLofts LTD | 7/20 | 277,334 | Jacksonville, FL | $24.9 MM | JaXNap |

| Rhino Capital LLC | Conguity 360 | 7/20 | 199,902 | Fall River, MA | $15.45 MM | Sale/leaseback – 10 year lease |

| Edgeconnex | EQT | 8/20 | Various | $3.4 BN | 40 properties @ 24 x EBITDA | |

| Landmark Infrastructure | Hillcorp | 9/20 | 138,000 | Lansing, MI | $52.5 MM | 3 property NNN LiquidWeb |

| Landmark Infrastructure | Sungard | 9/20 | 82,617 | Mississauga, ON | $28.83 MM | Sale/leaseback |

| Landmark Infrastructure | Sungard | 9/20 | 134,574 | Smynra, GA | Sale/leaseback | |

| Databank | zColo | 9/20 | 1,100,000 | Various | $1.4 BN | 44 properties – 14x EBITDA |

| Stonecourt Capital | CHIRISA | 10/20 | 230,000 | Various | 12 properties 22MW | |

| T5 Data Centers | Apple | 10/20 | 128,566 | Newark, CA | $60 MM | Former facebook – 17MW |

| Harrison St/1547 | Ascendant | 10/20 | 132,000 | Milwaukee, WI | $7.25 MM | 15 story carrier hotel |

| Landmark Infrastructure | Altus Group | 10/20 | 88,000 | Champaign, IL | $13.4 MM | Amdocs leased |

| Blackstone | COPT/GI | 11/20 | 1,300,000 | Ashburn, VA | $293 MM | (6) NNN Powered Base Shells |

| Harrison St / 1547 | Alco Investment | 12/20 | 302,262 | Portland, OR | $326 MM | Carrier Hotel |

Capitalization rates and EBITDA multiples are provided from sources deemed reliable.

Big Red Wines We Really Enjoyed During 2020

- Obsidian Ridge Sonoma Cabernet Sauvignon 2017 (N)

- Stag’s Leap Napa Fay Vyd. Cabernet Sauvignon 2017 (2N)

- Orrin Swift California Funeral Pyre Red Wine 2015 (2N)

- Pahlmeyer Napa Merlot, 2016 (N+1)

- Cliff Lede Napa High Fidelity Red Blend 2016 (N+1)

- Mount Peak Sonoma/Napa Sentinel Cabernet Sauvignon 2015(N+1)

Largest Wholesale Turn-Key Leases During 2020

| Tenant | Market | Provider | (MW) |

| Microsoft(PBB) | Franklin Park, IL | DLR | 192,000(SF) |

| Bloomberg(PBB) | Totowa, NJ | DLR | 150,000(SF) |

| Ashburn, VA | CloudHQ | 72 | |

| Ashburn, VA | CloudHQ | 60 | |

| Microsoft | Manassas, VA | CloudHQ | 60 |

| Bytedance | Ashburn, VA | Aligned | 54 |

| Bytedance | Ashburn, VA | DLR | 52 |

| Microsoft | Ashburn, VA | DLR | 40 |

| Microsoft | San Jose, CA | Stack | 32 |

| Microsoft | Sterling , VA | CONE | 24 |

| Microsoft | Ashburn, VA | NTT | 22 |

| Bytedance | Ashburn, VA | DLR | 20 |

| Microsoft | Elk Grove Village, IL | Stack | 18 |

| Microsoft | Elk Grove Village, IL | Stream | 15 |

| Workday | Ashburn, VA | Sabey | 12 |

| Atlanta, GA | QTS | 12 | |

| Hillsboro, OR | DLR | 12 | |

| Oracle | Sterling, VA | QTS | 10 |

| UBER | Sterling, VA | QTS | 10 |

| Rackspace | Manassas, VA | IRM | 9 |

| Bytedance | Sterling , VA | Vantage | 8 |

| Uber | Atlanta, GA | QTS | 8 |

| Microsoft | Phoenix, AZ | IRM | 6 |

| Oracle | Phoenix, AZ | IRM | 6 |

| Microsoft | Franklin Park, IL | DLR | 6 |

| Oracle | Phoenix, AZ | DLR | 6 |

| Oracle | Phoenix, AZ | CTL | 6 |

| Oracle | Sterling , VA | Vantage | 5 |

| NVIDIA | Tahoe, NV | SWCH | 5 |

| Tenant | Market | Provider | (MW) |

| Hillsboro, OR | Stack | 5 | |

| Uber | Ashburn, VA | QTS | 5 |

| Systems Integrator | Ashburn, VA | QTS | 5 |

| Oracle | Ashburn, VA | NTT | 5 |

| Oracle | Ashburn, VA | DLR | 5 |

| Citadel | Somerset, NJ | CONE | 5 |

| FedEX | Atlanta, GA | SWCH | 5 |

| Workday | Atlanta, GA | QTS | 4.5 |

| Citadel | Chicago, IL | QTS | 4.5 |

| Expanding customer | Santa Clara, CA | Vantage | 4 |

| US Patent & Trademark | Manassas, VA | IRM | 4 |

| Richmond, VA | QTS | 3.5 | |

| Government Contractor | Manassas, VA | OFC | 3.5 |

| Sterling, VA | STACK | 3 | |

| AWS | Manassas, VA | IRM | 3 |

| Dallas,TX | DLR | 3 | |

| Ebay | Reno, NV | SWCH | 3 |

| TBD | NYC | Sabey | 2 |

| Chicago | QTS | 2 | |

| Playstation | Chicago | QTS | 2 |

| IBM | Ashburn, VA | NTT | 2 |

| Ebay | Las Vegas, NV | SWCH | 2 |

| Deutsche Bank | Clifton, NJ | DLR | 2 |

| IBM | Ashburn, VA | DLR | 2 |

| Microsoft | Santa Clara, CA | COR | 2 |

| Los Angeles, CA | COR | 2 | |

| Wells Fargo | Chaska, MN | Flexential | 2 |

For the largest wholesale transactions, the numbers set forth represent what is believed to be the total commitment of the lease agreement. Under construction refers to white space being built. These numbers do not contemplate expansions. Information is from sources deemed reliable.

Learn more about North American Data Centers »