2017 Real Estate Forecast

Read our report that recaps 2016 market activity and highlights the trends that will shape data center real estate in 2017.

Download the 2017 Report (PDF) »

Overview of Issues Impacting Data Centers During 2016/2017

- Hyperscale cloud leasing led by Microsoft and Oracle in Multi-Tenant Data Centers (MTDC) drove a 25% increase in leasing activity from 2015; a historical high.

- Large cloud providers shifting from speculative leasing to pre-leasing during the past 15 months have been a welcome occurrence to the overall MTDC market.

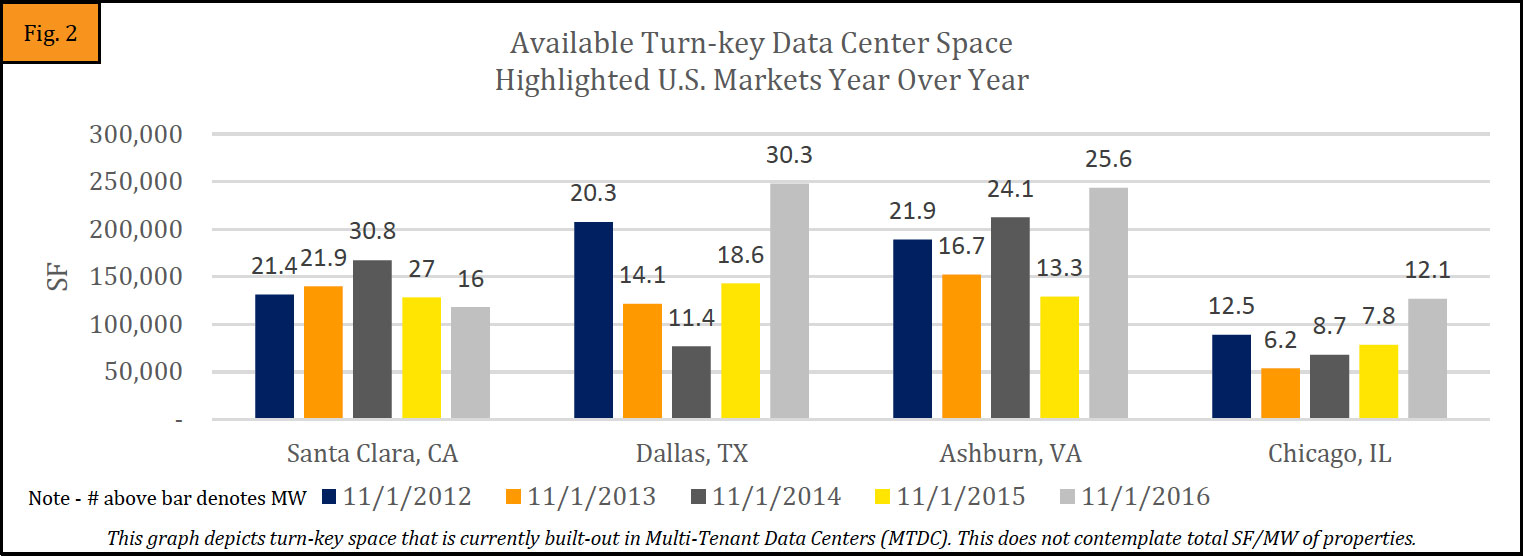

- Northern Virginia (Ashburn and Manassas) and Chicago continue to be a hotbed and have dominated MTDC leasing activity for 2016. We anticipate that construction in key markets will be met by strong leasing activity in the first half of 2017.

- New projects announced by CyrusOne, T5, EdgeConneX and Digital Realty, along with unprecedented data center leasing activity contributed to record leasing in the Chicago market.

- Significant sale–leaseback activity will continue to create shadow inventory and should augment the current scarcity of supply as evidenced in March by CME selling to CyrusOne in Aurora, IL and subsequent leasing with Oracle and Two Sigma.

- Overall rebound in enterprise users leasing wholesale, retail, hybrid, and cloud is expected in 2017.

- New projects in Quebec and Toronto will finally create MTDC assets in Canada. The decline in the Canadian Dollar has created parity for construction pricing to match some U.S. markets. However, rental rates remain significantly higher; Google, Amazon, Facebook, Softlayer and Microsoft have signed leases or are close.

- After a record 2015 for Mergers and Acquisitions (M&A) in the MTDC market, activity slowed in 2016, but transaction value remained high.

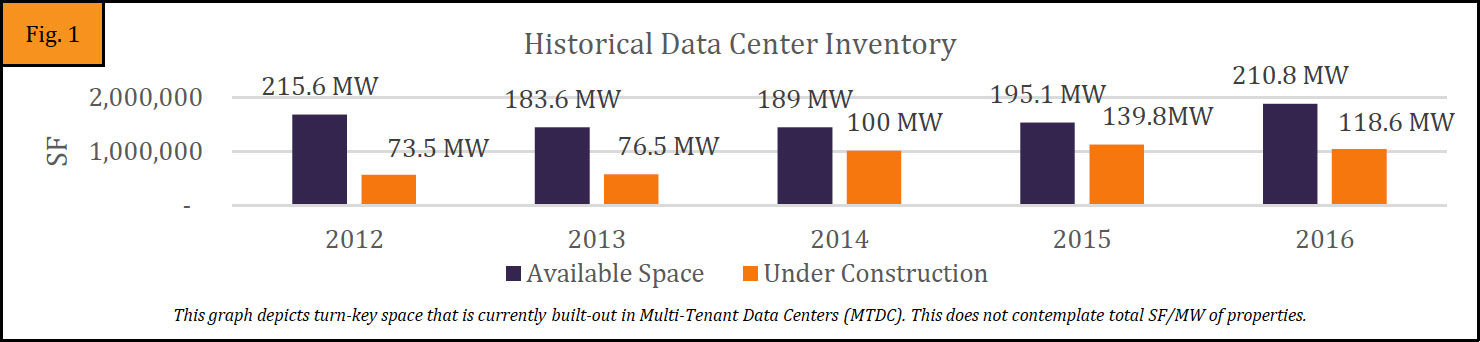

- Dearth of supply in the key MTDC markets (as noted in Fig. 2) There is only a 20% increase in turnkey space and space under construction despite these four markets accounting for more than 80% of 2016 leasing.

- As a result of large increases in data traffic, more subsea cable was laid during 2016 than the last five years combined.

- After a strong 2016, REIT stocks focused on data centers will see a short term setback related to rising interest rates but should otherwise rally during 2017 due to overall demand.

- Emergence of a new provider focusing on tertiary markets combining organic and inorganic opportunities.

- Starting in 2016 and expected to expand in the next year, there will be an increase in supply for less resilient data centers and N solutions. In addition, there will be an influx of properties that have densities ranging from 100/kW to over 300/kW. Currently available are N+1 and 2N solutions with higher densities.

- A small set of developers are delivering capacity near $5 million per MW. This is a confusing number often reflecting incremental capacity and less resiliency.

- There were several occasions in 2016 where major tenants have terminated leases early, providing some very attractive plug and play space. It remains to be seen whether density will be sufficient or excessive in markets such as Ashburn and Chicago in 2017.

- A decrease in rental rates on renewals may be offset by new tenants paying higher rates versus Power Based Buildings (PBB) rates during 2017 and 2018. The PBB market continues to ebb and flow, its primary issue being scarcity in supply.

- Data center lessees will continue to struggle in weighing the benefits of signing capital leases versus operating leases and trading term for flexibility. This will be particularly impactful on companies as they implement the Financial Accounting Standards Board (FASB) new lease accounting standards.

- Influx of new capital is driving cap rates at NNN properties to all-time lows based on two pending transactions.

Investment Activity 2016

Quarter 1

- GI Partners purchased a single tenant (TIAA-CREF) 92,800 sf data center in Broomfield, CO for $17.5 MM at a 6.3% cap rate.

- TierPoint completed the acquisition of Cosentry, which operates nine data centers throughout the Midwest.

- Carter Validus paid $8.5 MM for a 44,000 sf data center in Flint, MI, which is now 100% leased to Online Tech.

- Carter Validus acquired the 77,322 sf single tenant (SunGard) data center in Alpharetta, GA for $15.75 MM.

- The Chicago Mercantile Exchange Group sold its Aurora, IL 428,000 sf property (14.92 acres) to CyrusOne for $130 MM. The CME Group signed a 15-year 72,000 sf leaseback.

- Carter Validus purchased a 71,726 sf NNN property in Franklin, TN that is 100% leased to TierPoint for $19.4 MM.

Quarter 2

- Iron Mountain purchased 83 acres in Manassas, VA and has begun construction on its first 150,000 sf property.

- Zayo purchased Clearview International for $18.9 MM. It has two data centers in Dallas, TX and Waco, TX with approximately 30,000 sf.

- Lincoln Property purchased a 40,000 sf MTDC data center in Marlborough, MA for $19.5 MM or 7% cap rate.

- DuPont Fabros Technology, Inc. (DFT) sold its 360,000 sf data center in Piscataway, NJ to QTS Realty Trust, Inc. for $125 MM. It includes 88,000 sf of raised floor and approximately 18 MW.

Quarter 3

- Netrality acquired a four-property portfolio (two in St. Louis [490,456 sf] and two in Virginia) from Digital Realty Trust for $114.5 MM. Netrality sold its two, mostly vacant, Virginia properties (Herndon – 70,982 sf and Reston – 21,000 sf) to Lincoln Rackhouse for $8 MM. The two St. Louis properties sold at an 8 and 8.5% cap rate.

- Corporate Office Properties Trust (“COPT”) completed the formation of a joint venture with an affiliate of GI Partners. The venture acquired six of COPT’s existing single-tenant data center properties that contain a total of 962,000 sf. COPT realized $104 MM on the transaction.

- Digital Realty Trust purchased an 18.5 acre vacant property in Franklin Park, IL for $12.5 MM.

- EdgeConneX purchased a 132,000 sf vacant warehouse in Elk Grove Village, IL from Prologis for $22.8 MM.

- T5 purchased a 208,000 sf data center in Elk Grove Village, IL from Forsythe Technology.

- DFT acquired 46.7 acres of land in Hillsboro, OR for $11.2 MM.

- DFT acquired former 600,000 sf Toronto Star Plant in Vaughan, Ontario for $41.6 MM USD.

- ICONIQ took an equity position in two T5 Data Center projects: Plano, TX (315,000 sf) and Hillsboro, OR (110,000 sf). This $550 MM transaction was reported at a 6.8% capitalization rate.

- CyrusOne purchased a 23 acre parcel of land adjacent to the Aurora, IL property.

Quarter 4

- Carter Validus purchased the 288,000 sf (15.87 acre site) property in Hawthorne, CA that is leased to AT&T for $79.5 MM.

- CenturyLink agreed to buy Level 3 Communications Inc. for approximately $34 BN (~9x EBITDA).

- Carter Validus purchased McClean Data Center portfolios (2 buildings totaling 127,796 sf ) in McLean, VA for $85 MM at 7.5% cap rate.

- CenturyLink announced the sale of its 57 data centers and colocation business to a group of funds (BC Partners, Medina Capital Advisors and Longview Asset Management) for $2.15 BN(~9x EBITDA).

- Zayo Group Holdings, Inc. purchased a $12.8 MM 26,900 sf (3 MW) data center in Santa Clara, CA from Server Farm.

- Equinix Inc. announced the $3.6 BN acquisition of Verizon Communications, Inc. 24 data center sites (~13.6x EBITDA).

- Global Switch recently attracted a £2.4 billion cash investment, translating to a 49% stake or 23.1x multiple of trailing EBITDA.

- In December 2016, an entity associated with GI Partners purchased the 290,000 sf KOMO Plaza in Seattle, WA for $276 MM from Hines at a 5.9% cap rate.

- QTS Realty purchased the 260,000 sf Health Care Service Corporations data center in Dallas-Fort Worth for $50 MM and did a 5 year sale-leaseback.

Big Red Wines We Really Enjoyed During 2016

- Altvs Cabernet Sauvignon 2010

- Casa Piena Cabernet Sauvignon 2012

- Peacock Cabernet Sauvignon 2010

- Clos Pegase Cabernet Sauvignon 2012

- Melanson Cabernet Sauvignon 2012

- Duckhorn Paraduxx Proprietary Napa Red Wine 2012

- John Galt Cabernet Sauvignon Napa Valley 2012

North American Data Centers completed over 1,100,000 sf of transactions in 2016

Largest Wholesale Turn-Key Leases During 2016

| (MW) | |||

| Microsoft | Manassas, VA | CloudHQ | 35 |

| Microsoft | Elk Grove Vlg, IL | EdgeConneX | 30 |

| Microsoft | Ashburn, VA | CyrusOne | 22 |

| Microsoft | Santa Clara, CA | DFT | 16 |

| Microsoft | Phoenix, AZ | CyrusOne | 13.5 |

| Microsoft | San Antonio, TX | CyrusOne | 9 |

| Oracle | Sterling, VA | CyrusOne | 6 |

| Salesforce | Dallas, TX | QTS | 6 |

| Oracle | Ashburn, VA | CyrusOne | 5 |

| Oracle | Ashburn, VA | DLR | 5 |

| Oracle | Ashburn, VA | RagingWire | 4.2 |

| Softlayer | Dallas, TX | QTS | 4 |

| US Bank | Chaska, MN | Stream | 4 |

| Oracle | Franklin Park, IL | DLR | 4 |

| (MW) | |||

| Oracle | Chicago, IL | QTS | 3 |

| SunGard | Phoenix, AZ | CyrusOne | 3 |

| Oracle | Aurora, IL | CyrusOne | 3 |

| Uber | Ashburn, VA | DLR | 2.6 |

| Uber | Ashburn, VA | DLR | 2.6 |

| Comcast | Northlake, IL | Ascent | 2.2 |

| Walmart | Dallas, TX | CyrusOne | 2 |

| Zayo | Chicago, IL | Server Farm | 2 |

| Two Sigma | Aurora, IL | CyrusOne | 2 |

| Softlayer | Dallas, TX | CyrusOne | 2 |

| SoftLayer | Ashburn, VA | DLR | 2 |

| Softlayer | Ashburn, VA | Sabey | 2 |

| Softlayer | Ashburn, VA | RagingWire | 2 |

| Box | Santa Clara, CA | Vantage | 2 |

| ServiceNow | Toronto (Brampton) | Q9 | 2 |

For the largest wholesale transactions, the numbers set forth represent what is believed to be the total commitment of the lease agreement. Under construction refers to white space being built. These numbers do not contemplate expansions. Information is from sources deemed reliable.

Learn more about North American Data Centers »