2018 Real Estate Forecast

Read our report that recaps 2017 market activity and highlights the trends that will shape data center real estate in 2018.

Download the 2018 Report (PDF) »

Overview of Issues Impacting Data Centers During 2017

- Investmentent activity in data centers surpassed all other years during 2017 at over $20 BN.

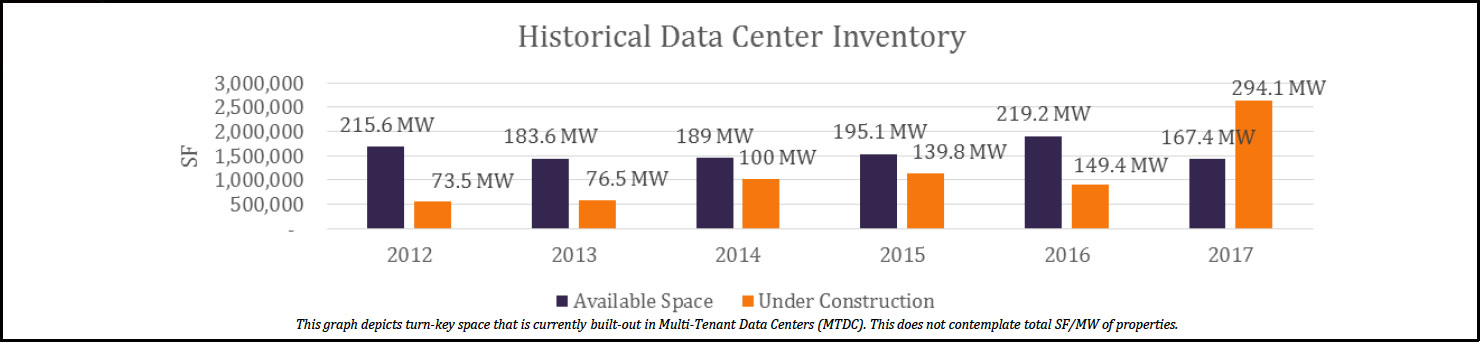

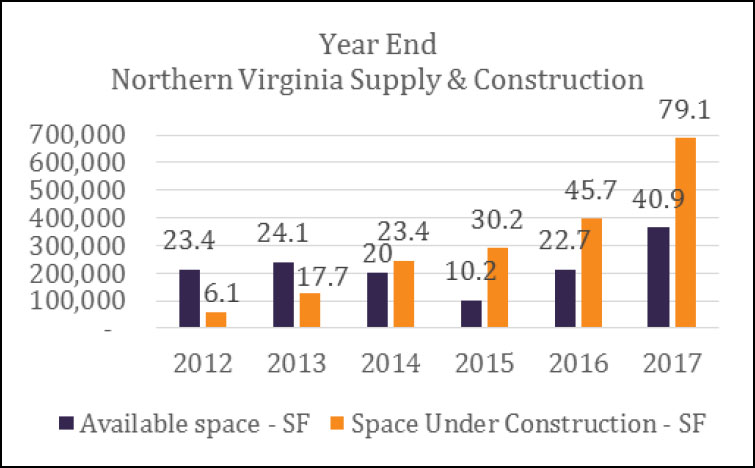

- Multi Tenant Data Center (MTDC) inventory under construction is almost double of what it was 12 months ago led by Northern Virginia.

- Significant uptick in private equity and venture capital looking at data center investments.

- Overall rental rates and concessions continue to hold steady, while construction costs have declined. In addition there are significant variances between resiliency and density.

- While hyperscale leasing is down compared to 2016, there are several properties under contract or recently purchased by MTDC developers that leasing activity from hyperscalesmay prove to be higherthan is divulged.

- Facebook and Apple return to leasing large blocks of MTDC as opposed to building their own after taking several years hiatus.

- There are a significant number of wholesale tenants that have leases expiring in 2018 & 2019.

- Significant uptick of colocation companies looking to lease at MTDC properties in several markets.

- Assimilation of 2017 mergers & acquisitions will likely see some fall out of non-core data centers, and sale- leaseback of large corporate data centers will continue to provide shadow inventory in 2018.

- Amazon coupled with Google expanding outside of MTDC in several projects in Northern Virginia.

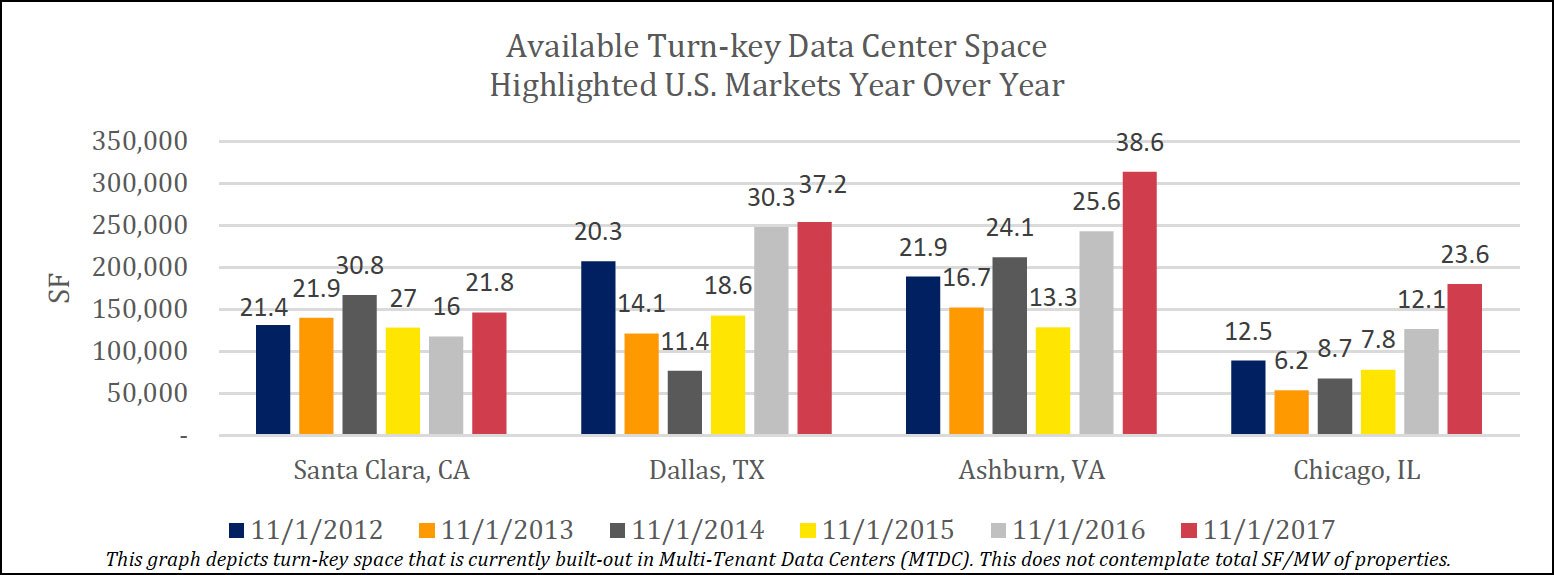

- Ashburn continued to dominate leasing activity during 2017.

- Several land acquisitions during 2017 in Loudoun County including; Google (148 acres), QTS (52 acres), Sentinel (100 acres), Vantage (42 acres), and Compass Data Centers (120 acres).

- Land prices in Ashburn have sold as high as $29/sf (2017) compared to Elk Grove Village at $27sf (2013) compared to Plano at $17/sf. Other sites within various submarkets may be lower.

- Slow down in leasing activity in Chicago in 2016 partly due to lack of inventory much of the year.

- 120 MW expansion of Itasca substation is expected by Mid 2018 with additional 120 MW in 2019/2020 will help spur several new developments in Suburban Chicago.

- Strong leasing activity in Dallas came from tenants expanding not hyperscale users and overall concern that there is a limited numberof enterprises in the market.

- Infomart looking to recapitalize portfolio in early 2018.

- QTS purchased 84 acres in Phoenix, AZ for $25 MM and EdgeConneX purchased 55 acres in Mesa, AZ.

- Santa Clara’s new inventory led to increased leasing led by Vantage at 13 MW after being hindered by lack of product.

- Several new MTDC data centers announced in Atlanta but historically there has been less than 6 MW’s of leasing activity annually.

- Blockchain and cryptocurrency requirements are driving new N solutions with less expensive power.

- In Canada, U.S. hyperscale companies, and Bitcoin continue to absorb space in Quebec, limited leasing thus far in Toronto.

- Significant multi-market leasing for latency sensitive requirements in MTDC led by YouTube Live. Others include Facebook Live, and POPS for hyperscale users.

- Expect an uptick in demand to absorb space in MTDC by Internet of Things (IOT), Artificial Intelligence (AI), and large Chinese cloud providers (Alibaba, Ten Cent, Baidu and others).

- Offshore capital made several investments in data center properties particularly in single tenant assets driving cap rates lower.

- Apple’s $1.375 BN new data center in Iowa follows major projects by Microsoft and Facebook. Facebook also building $1 BN property in Virginia.

Investment Activity 2017

| Buyer | Seller | Size | Market | Sales Price | Comments |

| Equinix | Verizon | Portfolio | Various | $3.6 BN | 13.3x EBITDA |

| GI Partners | Hines | 290,000 sf | Seattle, WA | $276 MM | 5.9% cap rate |

| QTS | Health Care Serv. | 260,000 sf | Dallas, TX | $50 MM | BCBS – 1 MW |

| Central Colo & Legacy | Meridian Group | 200,000 sf | Vienna, VA | $96 MM | Leidos & GSA leased |

| Carter Validus | El Dorado Holdings | 44,244 sf | Tempe, AZ | $16.4 MM | T-Mobile 6.7% caprate |

| Carter Validus | Spear Street Capital | 153,000 sf | Andover, MA | $37 MM | 7.3% cap rate |

| Digital Bridge Holdings | 365 Data Centers | Portfolio | Cleveland & Pittsburgh |

||

| Digital Bridge Holdings | C7 Data Centers | Portfolio | Various | $130 MM | |

| Peak 10 | Cbeyond Communications | 33,000 sf | Louisville, KY | $5.4 MM | |

| H5 Data Centers | ByteGrid | 333,215 sf | Cleveland, OH | $30.58 MM | 79% leased |

| CyrusOne | Sentinel | 11 MW 10 MW |

Sentinel,NJ&Raleigh- Durham,NC |

$245 MM $245 MM |

14.4x EBITDA |

| Cologix | Stonepeak Partners | Portfolio | Various | $1.35 BN | 17.7x EBITDA |

| Ascent | Kimball Bridge Partners | 5.5 MW | Alpharetta, GA | $30 MM | RIM partial lease back |

| Digital Bridge Holdings | Vantage Data Centers | Portfolio | Various | $1.308 BN | 17.0x EBITDA |

| Chirisa Investments | 365 Data Centers | 126,000 sf | 8 properties | ||

| Zayo | KO Networks | 10,000 sf | Various | $12 MM | 9.6x EBITDA |

| Green House Data | Cirracore | Various | |||

| Cyxtera | CenturyLink | Portfolio | Various | $2.8 BN | 9-10.0x EBITDA |

| Carter Validus | CyrusOne | 75,000 sf | Norwalk, CT | $57 MM | Cervalis 6.67% cap rate |

| Carter Validus | IT Provider | 60,000 sf | Charlotte, NC | $16.112 MM | ATOS |

| Digital Realty Trust | Private Investor | 264,000 sf | Franklin Park, IL | $14.4 MM | 2 year warehouse lease |

| Digital Realty Trust | DuPont Fabros | Portfolio | Various | $7.594 BN | 21.2x EBITDA |

| Peak 10 | ViaWest | Portfolio | Various | $1.675 BN | 16.4x EBITDA |

| DataBank | Stream Realty | 145,000 sf | Dallas, TX | ||

| Carter Validus | 250 Williams Street | 995,728 sf | Atlanta, GA | $166 MM | |

| Lincoln Rackhouse | Coca Cola | 88,000 sf | Atlanta, GA | $19 MM | Partial lease back |

| Iron Mountain | Fortrust | 210,000 sf | Denver, CO | $128 MM | 13.0x EBITDA |

| Carter Validus | Westcore Properties | 76,573 sf | Sunnyvale, CA | $36.8 MM | Qwest 6.5% cap rate |

| Carter Validus | CF Equipment Loans | 58,000 sf | Cincinnati, OH | $10.3 MM | GE 7% cap rate |

| Carter Validus | Red Sea Group | 49,800 sf | Kingof Prussia,PA | $19.2 MM | Verizon 6.5% cap rate |

| Carter Validus | Lexington Realty Trust | 58,560 sf | Tempe, AZ | $15.2 MM | Wipro 7.4% cap rate |

| CyrusOne | 48 acres | Quincy, WA | |||

| Zayo | Stream Realty | 29,500 sf | Denver, CO | $3.5 MM | |

| 1547 / CIM Group | 400 Paul Avenue | 7.3 acres | San Francisco,CA | ||

| Digital Realty Trust | Carter Validus | 251,141 sf | Northlake, IL | $315 MM | 7% cap rate |

| Mapletree Investments | Carter Validus | Portfolio | Various | $750 MM | |

| Peak 10/ViaWest | Glaxo Smith Kline | 203,000 sf | Philadelphia, PA | $32.9 MM | 25 acres |

| Global Securitization | COPT | 193,000 sf | Chesterfield Cty,VA | $44 MM | 11% cap rate |

| Microsoft | Chevron | 202,000 sf | San Antonio, TX | $80 MM | 34 acres |

| 1547 | ICE | 41,225 sf | Markham, Ontario | ||

| Server Farm Realty | AMD | 151,588 sf | Suwanee, GA | ||

| Iron Mountain | IO Data Centers | Portfolio | Various | $1.3 BN | 15.6x EBITDA |

| Stream Realty | Seefried Properties | 107,000 sf | Elk Grove Vlg., IL | $18.86 MM | Warehouse sold for $175/sf |

| Digital Realty Trust | Centerpoint Properties | 1.4 acres | Chicago, IL | $25 MM | Adjacent to350ECermak |

| Carter Validus | BP | 103,200 sf | Houston, TX | $74.78 MM | 6.8%caprate |

| GI Partners | Ericsson | 215,000 sf | Montreal, Quebec | ||

Big Red Wines We Really Enjoyed During 2017

- ObisidianThe Slope Cabernet Sauvignon 2015 (N)

- Charles Smith Substance Cabernet Sauvignon 2015 (N)

- FreemarkAbbey Cabernet Sauvignon 2012 (N+1)

- Shafer One Point Five Cabernet Sauvignon 2014 (N+1)

- BoeschenEstate Cabernet Sauvignon (N+1)

- NeyersAME Cabernet Sauvignon 2013 (N+1)

- Joseph Phelps Bacchus Cabernet Sauvignon 2006 (2N)

- Far NienteCabernet Sauvignon 2014 (2N)

Largest Wholesale Turn-Key Leases During 2017

| Tenant | Market | Provider | (MW) |

| Ashburn, VA | DFT | 22 MW | |

| Microsoft | San Antonio, TX | CyrusOne | 18 MW |

| Apple | Ashburn, VA | DFT | 14.5 MW |

| Apple | Chicago, IL | DFT | 14.5 MW |

| Ashburn, VA | DLR | 12 MW | |

| Microsoft | Phoenix, AZ | CyrusOne | 12 MW |

| Ashburn, VA | CyrusOne | 10 MW | |

| Facebook (renewal) | Santa Clara, CA | DLR | 6 MW |

| Uber | Phoenix, AZ | Aligned | 5 MW |

| Uber | Ashburn, VA | DLR | 4.8 MW |

| Existing cust. | Dallas, TX | DLR | 4 MW |

| Healthcare | Dallas, TX | DLR | 4 MW |

| Softlayer | Dallas, TX | DLR | 4 MW |

| Los Angeles, CA | Core | 4 MW |

| Tenant | Market | Provider | (MW) |

| NVIDIA | Santa Clara, CA | Vantage | 3.5 MW |

| Zayo | Los Angeles, CA | GI Partners | 2.5 MW |

| Two Sigma | Chicago, IL | CyrusOne | 2.2 MW |

| PayPal | Phoenix, AZ | Aligned | 2.1 MW |

| SunGard | Boston, MA | 109 Brookline | 2 MW |

| Oracle | Dallas, TX | CyrusOne | 2 MW |

| Oracle | Dallas, TX | DLR | 2 MW |

| Cloud Firm | Irving, TX | QTS | 2 MW |

| Vanguard | Ashburn, VA | CyrusOne | 2 MW |

| Alibaba | Ashburn, VA | DLR | 2 MW |

| Georgia Tech | Atlanta, GA | DataBank | 2 MW |

| NVIDIA | Santa Clara, CA | Colovore | 2 MW |

| Dallas, TX | Infomart | 2 MW | |

| Apple | Austin, TX | Data Foundry | 2 MW |

| SAP | Ashburn, VA | DLR | 1.8 MW |

25% increase in inventory of Multi Tenant Data Centers (MTDC) available or being built compared to last year. Share on X

For the largest wholesale transactions, the numbers set forth represent what is believed to be the total commitment of the lease agreement. Under construction refers to white space being built. These numbers do not contemplate expansions. Information is from sources deemed reliable.

Learn more about North American Data Centers »